What is a Temporary Buydown?

Temporary buydowns are a hot topic in today's real estate market. They can be a win-win for both buyers and sellers, but what exactly are they?

A temporary buydown is a mortgage financing option where the interest rate on a loan is temporarily reduced, typically for the first few years. This is done by an upfront cash deposit that is then released from an escrow account each month, allowing the lender to temporarily reduce the buyer's interest rate and monthly payments.

Our Buydown Programs

We offer eligible borrowers a variety of temporary buydown programs:

-

Seller-Paid Buydowns:

-

3-2-1 Buydown: Reduces the note rate by 3% the first year, 2% the second, and 1% the third. The non-reduced rate applies years 4-30.

-

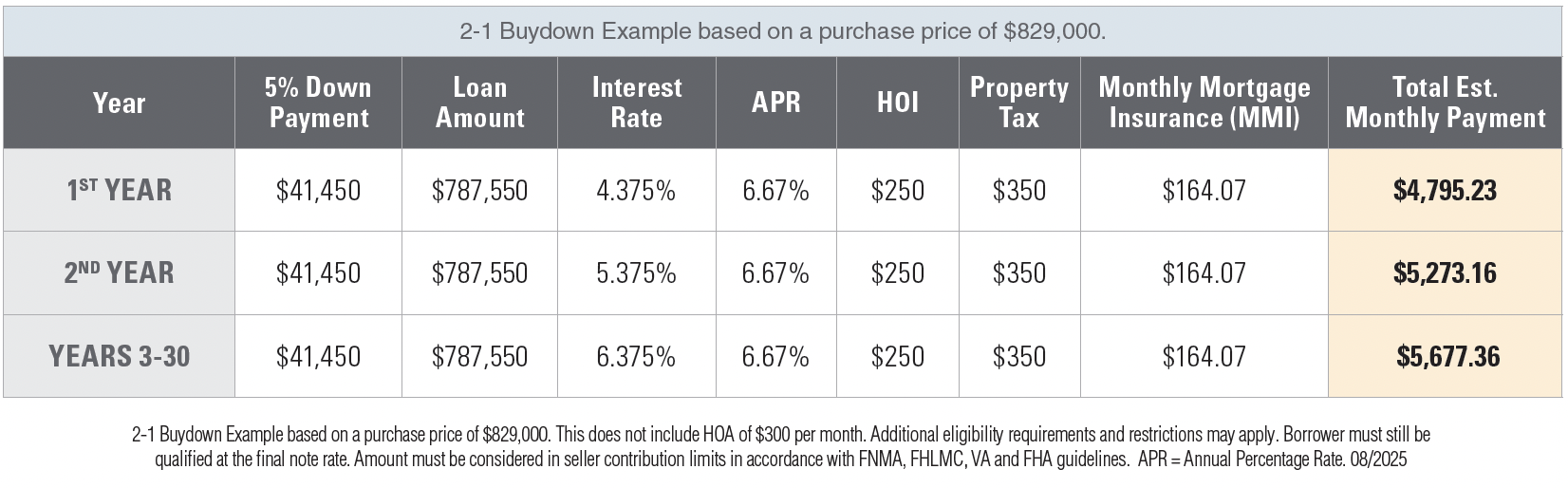

2-1 Buydown: Reduces the note rate by 2% the first year, followed by 1% the second. The non-reduced rate applies years 3-30.

-

1-0 Buydown: Reduces the note rate by 1% the first year. The non-reduced rate applies years 2-30.

EXAMPLE:

-

-

Lender-Paid Buydown:

-

KickSTART 1-0 Buydown: Your interest rate is lowered by one full percentage point (1%) for the first 12 months of your mortgage. This directly translates to lower monthly payments during that initial year, putting more money in your pocket as you settle in. Learn more about KickSTART, its terms and conditions here.

-

Eligible borrowers must still be qualified at the final note rate.

Benefits to the Seller:

-

Attract more buyers in a high-rate environment.

-

Avoid reducing the home's list price.

Benefits to the Buyer:

-

A lower initial interest rate and more affordable monthly payments.

-

The stability of a fixed-rate loan after the buydown period ends.

-

More cash upfront to use for other expenses.

Temporary Buydown vs. Discount Points: The key difference between a temporary buydown and discount points is the duration of the lower rate. Discount points are used to buy down the interest rate for the entire life of the loan, while a temporary buydown will only lower the rate for the agreed-upon buydown period. Once the buydown funds run out, the buydown period ends and the original note rate applies.

Contact one of our Loan Officers for more information on temporary buydowns and how they could work for you!

The information contained herein (including but not limited to any description of TowneBank Mortgage, its affiliates and its lending programs and products, eligibility criteria, interest rates, fees and all other loan terms) is subject to change without notice. This is not a commitment to lend.