Fed Decision Coming December 10: What It May Mean For Mortgage Rates

I hope everyone had a great Thanksgiving. As we head into the final stretch of the year, the Federal Open Market Committee is preparing for another key decision on the Fed Funds Rate.

And once again, we’re in “wait and see” mode.

What the Market Expects on December 10

Current market data suggests an 88 percent probability of a 25 bp rate cut next week.

Inside the FOMC, opinions remain split:

-

Some members are still hawkish about inflation and do not want to cut rates further,

-

While others are concerned about slowing employment growth, wanting to cut more

I think that most people would accept a bet with an 84% chance of winning, so let’s assume that the Fed does indeed cut another 25 bps on December 10. The bigger questions for the housing market are how will the bond market react to the Fed’s decision and what will mortgage rates do?

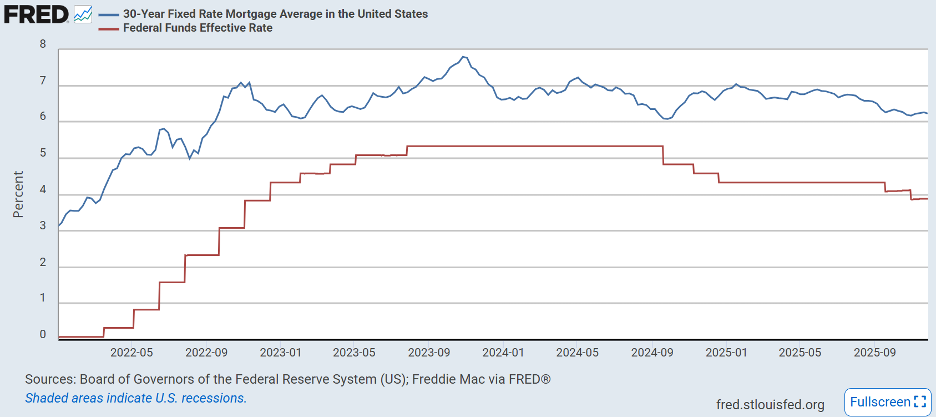

This chart is from the St. Louis Federal Reserve Bank showing movements in the Fed Funds Rate and 30 Year Fixed Mortgage Loan Rates since 2022.

- We saw the Fed raise fed fund rates aggressively in 2022-2023 and mortgage rates moved similarly

- Last Fall, the Fed cut fed fund rates by 100 bps and mortgage rates rose by a similar amount!

- This year, mortgage rates rose somewhat after each of the two 25bp cuts, and are currently about the same as just before the Fed made its first cut in September

This time around, there hasn’t been the normally available economic data for the Fed to digest because of the recent government shutdown. But anticipating that the 25 bp rate cut does happen, then mortgage rates will probably move little until the following week when new CPI data will be published on December 18:

- Scenario 1: Inflation holds at 3 percent or rises

- → Mortgage rates likely rise again

- Scenario 2: Inflation improves

- → Rates may begin drifting down toward 6 percent

This CPI report will carry more weight than the Fed’s announcement.

Should You Lock or Wait?

If you’re weighing whether to lock in your mortgage rate now or wait until after the Fed’s announcement next week, consider the benefits of certainty. Current rates are historically favorable, and even if the Fed makes a cut on December 10, the positive impact on mortgage rates in the near term is likely to be limited. This anticipated cut may even result in a temporary increase in mortgage rates!

Locking now can help you avoid potential volatility and give you peace of mind as you move forward. Wishing you a happy holiday season!

Jim Miller

President & CEO

TowneBank Mortgage